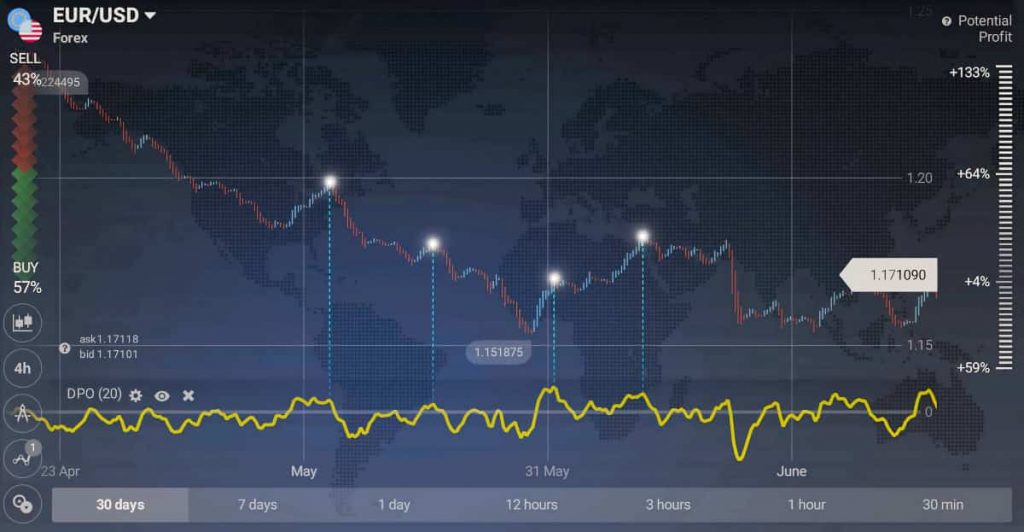

Detrended Price Oscillator – How to use it in trading. Why traders should use DPO? How to set it up on IQ Option trading platform?

Detrended price oscillator (DPO) is an indicator that tries to eliminate a long-term trend from price behaviour. The primary purpose of the index is to help find short-term price cycles which, in turn, help pinpoint local turning points.

Additionally, the indicator can be used as an overbought/oversold measure.

Unlike the Stochastic and the MACD, the DPO is not a momentum indicator. It is used to identify the high and low points within the cycle and to estimate its length. Read the full article to find out how to apply it in trading!

What is DPO?

As can be seen from the name of the indicator itself, the DPO is used to remove the influence of a long-term trend from current prices. But why should a trader do it? Should not it follow the trend? Sometimes it is easier to estimate the longevity of a trend and predict an imminent reversal when price movements linked to the trend are completely removed from the chart.

What you get at the end is a curve, quite similar in its form to the real price chart. The most obvious difference between the two is the lack of an important trend on the DPO. To use the indicator correctly it is important to understand that the Detrended Price Oscillator is based on the use of a moving average, moving several periods to the left. The indicator will compare past prices with a moving average.

How to set it up?

The setting of the Detrended Price Oscillator is simple. To do this you must:

- Click on the “Indicators” button at the bottom left of the screen,

2. Select “DPO” from the list of available options,

3. Without changing the default settings and confirm with the “Apply” button.

The indicator is ready to be used on IQ Option platform!

How to use it in trading?

As mentioned above, the Detrended Price Oscillator measures the difference between the past price and the moving average. The horizontal line corresponds to the moved moving average. Thus, the DPO is positive when the price is above average and negative when the price is lower.

The indicator is particularly useful when trading on shorter time intervals. Not being interested in long-term trading, you may want to exclude long-lasting trends from your estimates and consider only shorter fluctuations. For this purpose there is no better tool than the DPO. If this is your case, take a look at the DPO before opening the transaction and you will know to what extent the prevailing trend is responsible for price changes.

The DPO can also be used to estimate the average duration of the cycle. For example, when trading with CFDs on a given stock, you can know the amount of time needed to earn the price and then start going down. Financial markets have a tendency to repeat themselves. The periods of growth, therefore, alternate with periods of depression. Using the DPO you can be prepared for a next trend inversion. Calculates the distance between peaks and nearby drops to estimate the average cycle time. Consider using it later when the current cycle is about to end.

The indicator is best used as a support tool and can be combined with a trend following indicator (MA, Alligator), with MACD or ATR.

Watch testing of Detrended Price Oscillator on historical data:

Important takeaways:

- If troughs have actually traditionally had to do with 2 months apart, that might assist a trader make future choices as they can find the most current trough and identify that the next one might happen in about 2 months.

- The DPO is utilized for determining the range between peaks and troughs in the price/indicator.

- The indicator is usually set to recall over 20 to 30 durations.

- Traders can utilize the approximated future peaks as selling possibilities or the approximated future troughs as buying possibilities.

Source:

IQOption blog

https://www.investopedia.com/terms/d/detrended-price-oscillator-dpo.asp

How to trade CFD? (00:49)

How to trade CFD? (00:49) How to trade binary options*? (01:22)

How to trade binary options*? (01:22) Forex. How to start? (01:01)

Forex. How to start? (01:01)