1. Introduction

Olymp Trade is an online broker established in 2014, providing users with a straightforward and user-friendly trading experience. The platform primarily focuses on Forex and binary options trading, catering to both beginner and experienced traders. With its innovative approach to trading, Olymp Trade has garnered multiple industry awards and has built a loyal user base.

2. Account opening

Opening an account with Olymp Trade is a hassle-free process. You simply need to provide your name, email address, and create a password. Once you verify your email address, you can access the platform and explore its features. Olymp Trade offers two types of accounts: Standard and VIP, with minimum deposits of $10 and $2000, respectively. VIP accounts come with additional benefits, such as higher returns and personalized support.

Step 1: Visit the Olymp Trade Website

To begin the account opening process, visit the Olymp Trade website at https://olymptrade.com. On the homepage, you’ll find an overview of the platform’s features and benefits, as well as testimonials from satisfied users.

Step 2: Register for an Account

Click the “Start Trading” or “Register” button, which is typically located at the top right corner of the homepage. This will take you to the account registration page, where you’ll need to provide some basic personal information. You have the option to register with your email address or your Facebook or Google account. If you choose to register with your email, enter a valid email address and create a strong password. Remember to read and agree to the terms and conditions and privacy policy before proceeding.

Step 3: Choose Your Account

Type Once you’ve successfully registered, you’ll be asked to choose between a Standard and a VIP account. Here’s a quick breakdown of the differences between the two: Standard Account: This account type requires a minimum deposit of $10 and provides access to all basic trading features and educational resources. It’s ideal for beginners or those with a smaller trading budget. VIP Account: With a minimum deposit of $2,000, this account type offers additional benefits such as faster withdrawals, a personal account manager, and exclusive educational materials. It’s best suited for experienced traders or those with a larger trading budget. Select the account type that best fits your needs and proceed to the next step.

Step 4: Complete Your Profile

After choosing your account type, you’ll be prompted to complete your profile. Provide accurate personal information, such as your full name, date of birth, country of residence, and phone number. This information is crucial for identity verification and ensuring the security of your account.

Step 5: Verify Your Identity

Olymp Trade, like any reputable broker, adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. As a result, you’ll need to verify your identity by submitting relevant documentation. Typically, this involves providing a government-issued photo ID (such as a passport or driver’s license) and proof of residence (such as a utility bill or bank statement). You can upload these documents directly through the platform. The verification process may take a few days, but once it’s complete, you’ll be able to deposit funds and start trading.

Step 6: Fund Your Account

To start trading, you’ll need to deposit funds into your Olymp Trade account. The platform supports a variety of payment methods, including credit/debit cards, e-wallets (such as Neteller and Skrill), and cryptocurrencies. Choose the payment method that works best for you and follow the on-screen instructions to complete the deposit. Remember that the minimum deposit for a Standard account is $10, while a VIP account requires a minimum deposit of $2,000.

Step 7: Familiarize Yourself with the Trading Platform

Before diving into live trading, take some time to familiarize yourself with the Olymp Trade platform. Explore the various features, tools, and educational resources available to you. This will help you become

3. Broker Fees

Olymp Trade has a transparent fee structure, ensuring that traders are aware of the costs associated with their transactions. The platform mainly operates on a commission-based model, where a fixed percentage of the trade amount is charged as a fee. For Forex trades, Olymp Trade uses spreads that vary depending on the asset being traded. Additionally, the platform does not charge any deposit or withdrawal fees, making it an attractive option for cost-conscious traders.

Pros and Cons of Olymp Trade Broker Fees

Olymp Trade is a reputable online trading platform known for its transparent fee structure and competitive rates. Here, we outline the pros and cons of Olymp Trade’s broker fees to help you make an informed decision when choosing a trading platform.

Pros

- Transparent Fee Structure: Olymp Trade is transparent about its fees and charges. There are no hidden costs, and traders can easily access all fee-related information on the platform.

- Fixed Commissions: The platform charges a fixed commission on each trade, which ranges from 1-2% of the trade amount, depending on the asset. This fixed fee structure makes it easy for traders to calculate costs and manage their trading expenses.

- No Deposit or Withdrawal Fees: Olymp Trade does not charge any fees for deposits or withdrawals. This is a significant advantage for traders, as it allows them to keep more of their profits and reduces the overall cost of trading.

- Competitive Spreads: Olymp Trade offers competitive spreads on various financial instruments, ensuring that traders have access to cost-effective trading opportunities.

- Minimal Non-Trading Fees: The platform has minimal non-trading fees, such as inactivity fees, which allows traders to focus more on their trading activities without worrying about unnecessary costs.

Cons

- Commission on Each Trade: The fixed commission on each trade, while transparent, may not be ideal for all traders. High-frequency traders or those with a smaller trading budget may find the commission structure less favorable compared to platforms that charge based on spreads alone.

- No Tiered Fee Structure: Olymp Trade does not offer a tiered fee structure that rewards high-volume traders with reduced commissions. This could be a disadvantage for active traders who may find more favorable fee structures elsewhere.

- Limited Fee Reductions for VIP Accounts: While VIP account holders enjoy certain benefits, such as faster withdrawals and a personal account manager, they do not receive significant fee reductions compared to standard accounts. This may not be appealing for traders who seek more cost-saving advantages with a premium account.

- No Support for ECN Trading: Olymp Trade does not offer Electronic Communication Network (ECN) trading, which provides traders with access to tighter spreads and lower commissions. Traders who prefer ECN trading may find the platform’s fee structure less attractive.

In conclusion, Olymp Trade’s transparent and competitive fee structure is suitable for many traders, particularly those looking for a straightforward approach to trading costs. However, high-frequency traders and those seeking a tiered fee structure may find other platforms more fitting for their needs.

4. Deposit and withdrawal

The broker offers various deposit and withdrawal methods, including bank transfers, credit/debit cards, and popular e-wallets like Skrill and Neteller. The platform processes withdrawal requests within 24 hours, and funds are typically received within 1-3 business days. Olymp Trade’s minimum deposit amount is $10, making it accessible to traders with limited capital.

Pros and Cons of Olymp Trade Broker Deposit and Withdrawal Methods

Olymp Trade offers a variety of deposit and withdrawal methods to cater to the needs of its diverse clientele. In this list, we highlight the pros and cons of these methods to help you better understand the advantages and potential drawbacks associated with funding and withdrawing from your Olymp Trade account.

Pros

- Multiple Payment Methods: Olymp Trade supports a wide array of payment options, including credit/debit cards, e-wallets like Neteller and Skrill, and cryptocurrencies. This diversity allows traders to choose the most convenient and accessible method for them.

- No Deposit or Withdrawal Fees: The platform does not charge any fees for deposits or withdrawals, regardless of the payment method used. This ensures that traders can keep more of their profits and reduces the overall cost of trading.

- Fast Withdrawal Processing: Olymp Trade is known for its quick withdrawal processing times. Standard account holders typically receive their funds within 24 hours, while VIP account holders enjoy even faster withdrawal processing.

- Secure Transactions: Olymp Trade uses advanced encryption technology to safeguard users’ personal and financial information, ensuring secure and reliable transactions.

- Minimal Deposit Requirements: The platform’s minimum deposit requirement is just $10 for a standard account, making it accessible to traders with varying budgets and financial capabilities.

Cons

- Withdrawal Limitations: While Olymp Trade offers multiple withdrawal methods, certain restrictions may apply, such as withdrawal limits or the unavailability of specific methods in certain countries. These limitations may pose an inconvenience for some traders.

- Verification Requirements: Before withdrawing funds for the first time, traders are required to verify their identity and complete the KYC (Know Your Customer) process. While this process is essential for regulatory compliance and account security, it may cause delays and inconvenience for some users.

- Bank Transfer Unavailability: Olymp Trade does not support direct bank transfers for deposits and withdrawals. Traders who prefer using this traditional method may find this limitation unfavorable.

- Withdrawal Processing Times May Vary: While Olymp Trade generally processes withdrawals quickly, processing times may still vary depending on the chosen payment method and the user’s bank. This may result in longer waiting times for some traders.

- Dependent on Third-Party Providers: Olymp Trade’s deposit and withdrawal methods rely on third-party payment providers, which may impose their own fees or restrictions. This could potentially impact the overall cost and convenience of funding and withdrawing from your account.

In summary, Olymp Trade provides a range of deposit and withdrawal methods, catering to the needs of a diverse user base. The platform’s fee-free transactions and fast processing times are advantageous for traders. However, certain limitations and restrictions may affect the convenience and accessibility of these methods for some users.

5. Web trading platform

Olymp Trade’s web trading platform is known for its user-friendly interface and ease of use. It comes with advanced charting tools, customizable indicators, and multiple timeframes to suit different trading strategies. The platform’s responsive design ensures seamless trading, even on slower internet connections.

Pros and Cons of Olymp Trade Broker Web Trading Platform

Olymp Trade’s web trading platform is designed to provide traders with a user-friendly and intuitive trading experience. This list outlines the pros and cons of the platform to help you determine whether it’s the right fit for your trading needs.

Pros

- User-friendly Interface: The Olymp Trade web platform features a clean, well-organized interface that is easy to navigate, even for beginners. This user-friendly design allows traders to focus on their trading activities without getting overwhelmed by a cluttered workspace.

- Advanced Charting Tools: Olymp Trade’s web platform offers advanced charting capabilities with various chart types, timeframes, and technical indicators. This enables traders to conduct in-depth market analysis and make well-informed decisions.

- Customizability: The web platform allows traders to customize their trading workspace by adding, removing, or rearranging various elements, such as charts, watchlists, and trading tools. This level of customization helps create a personalized trading environment suited to individual preferences and needs.

- One-Click Trading: The platform features one-click trading functionality, enabling users to quickly execute trades with minimal delays. This is especially beneficial for traders who need to react swiftly to changing market conditions.

- No Download Required: As a web-based platform, Olymp Trade does not require any software downloads or installations. Traders can access the platform directly from their internet browser, making it easily accessible from any device with an internet connection.

Cons

- Internet Connection Dependency: As a web-based platform, Olymp Trade requires a stable internet connection to function effectively. This may pose an issue for traders in areas with unreliable internet connectivity or during temporary outages.

- Limited Trading Tools Compared to Desktop Platforms: While Olymp Trade’s web platform offers a range of trading tools, it may lack some of the advanced features and functionalities available on dedicated desktop platforms. This could be a disadvantage for experienced traders who require more sophisticated tools for their trading strategies.

- Potential Browser Compatibility Issues: Although the Olymp Trade web platform is designed to work with most modern internet browsers, some users may still encounter compatibility issues or performance limitations depending on their browser or device.

- No Support for Automated Trading: The web platform does not support automated trading strategies or the use of trading robots. This may be a drawback for traders who rely on algorithmic trading techniques.

- Less Control over Platform Updates: As a web-based platform, updates and changes to the Olymp Trade platform are made automatically and may not always be in line with individual preferences. This means that traders have less control over their trading environment compared to using a downloadable desktop platform.

In conclusion, Olymp Trade’s web trading platform offers a user-friendly and accessible trading experience with a range of useful features and tools. However, traders who require more advanced functionality or prefer a greater degree of control over their trading environment may find the platform less suitable for their needs.

6. Mobile trading platform

The Olymp Trade mobile app, available for both Android and iOS devices, offers a convenient and seamless trading experience. It replicates the web platform’s features, including charting tools and various indicators, making it ideal for traders on the go.

Pros and Cons of Olymp Trade Broker Mobile Trading Platform

Olymp Trade’s mobile trading platform is designed to provide a seamless and convenient trading experience on the go. In this list, we outline the pros and cons of Olymp Trade’s mobile platform to help you decide if it’s the right choice for your trading needs.

Pros

- Accessibility: Olymp Trade’s mobile platform is available for both iOS and Android devices, allowing traders to access their accounts and trade from virtually anywhere with a stable internet connection.

- User-friendly Interface: The mobile platform features a clean, intuitive design that closely resembles the web platform, making it easy for traders to navigate and use even on smaller screens.

- Real-time Trading: The mobile app allows users to execute trades, monitor positions, and manage their accounts in real-time, ensuring they never miss an opportunity.

- Charting and Technical Analysis Tools: Olymp Trade’s mobile platform offers a variety of charting options and technical analysis tools, enabling traders to conduct on-the-go market analysis and make informed decisions.

- Customizable Price Alerts: The mobile app allows users to set customizable price alerts, ensuring they are notified of important market movements without having to constantly monitor their devices.

Cons

- Limited Screen Size: Mobile devices typically have smaller screens than desktop computers or laptops, which can make it more challenging to view charts, analyze data, and manage multiple trades simultaneously.

- Reduced Functionality Compared to Desktop Platforms: Although the mobile platform offers many of the same features as the web platform, it may lack some advanced tools and functionalities available on dedicated desktop platforms, making it less suitable for advanced traders.

- Dependency on Internet Connection: Similar to the web platform, the mobile app requires a stable internet connection to function effectively. This could pose issues for traders in areas with poor connectivity or during temporary outages.

- Battery Consumption: Using the mobile trading platform extensively may result in significant battery consumption on your device, potentially limiting your ability to trade throughout the day without access to a power source.

- No Support for Automated Trading: Olymp Trade’s mobile platform, like its web counterpart, does not support automated trading strategies or the use of trading robots. This may be a disadvantage for traders who rely on algorithmic trading techniques.

In summary, Olymp Trade’s mobile trading platform offers a convenient and user-friendly solution for traders looking to access their accounts and trade on the go. However, some limitations, such as reduced functionality compared to desktop platforms and reliance on a stable internet connection, may impact the overall trading experience for certain users.

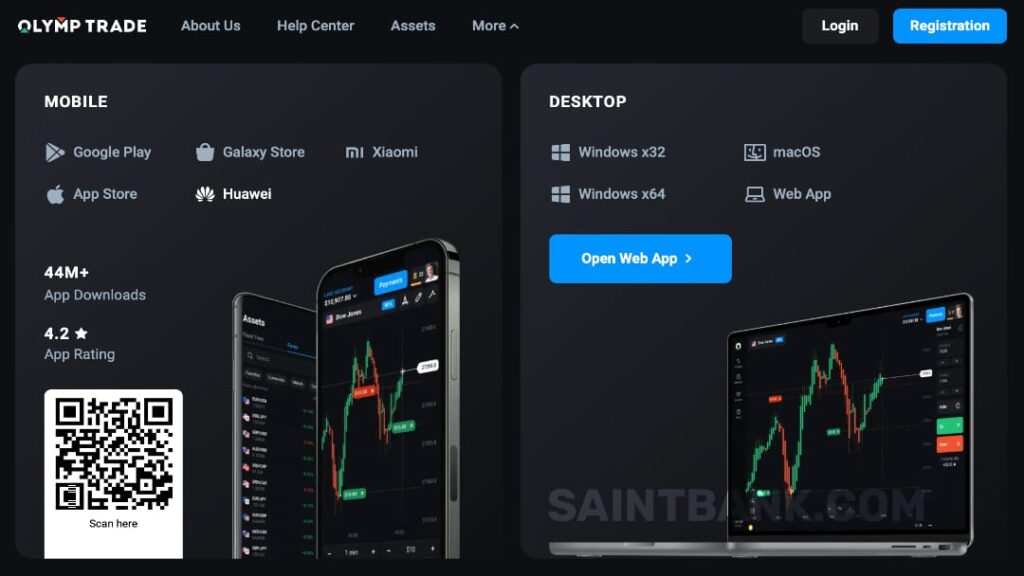

7. Desktop trading platform

Currently, Olymp Trade does not offer a dedicated desktop trading platform. However, their web trading platform is compatible with most web browsers and can be accessed on desktop computers.

8. Markets and products

Olymp Trade offers a limited but diverse range of tradable assets, including currency pairs, commodities, indices, and stocks. This selection caters to traders with varying interests and strategies, though it may not be as extensive as those offered by other brokers.

Olymp Trade Broker Markets and Products

Olymp Trade offers a diverse range of trading instruments across various markets, allowing traders to create diversified portfolios and explore different trading opportunities. The following list highlights the markets and products available on the Olymp Trade platform:

- Forex: Olymp Trade provides access to a wide variety of currency pairs, including major, minor, and exotic pairs. Traders can capitalize on the highly liquid forex market and take advantage of the 24-hour trading sessions.

- Commodities: The platform offers various commodities for trading, including popular options such as gold, silver, crude oil, and natural gas. These instruments allow traders to speculate on the price movements of essential raw materials and diversify their portfolios.

- Indices: Traders can access leading global stock indices on Olymp Trade, such as the S&P 500, NASDAQ, Dow Jones, FTSE 100, and more. Index trading enables users to speculate on the overall performance of a basket of stocks without having to invest in individual companies.

- Stocks: Olymp Trade offers a selection of popular stocks from well-known companies across various industries and countries. This allows traders to capitalize on market movements and build a diversified stock portfolio.

- ETFs: The platform provides access to a range of Exchange Traded Funds (ETFs) that track the performance of different indices, sectors, or asset classes. ETFs offer traders a cost-effective and convenient way to gain exposure to various markets with a single trade.

- Cryptocurrencies: Olymp Trade supports the trading of popular cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, and Ripple. Crypto trading offers traders the opportunity to speculate on the price movements of digital currencies in a rapidly evolving market.

- Options Trading: In addition to traditional trading instruments, Olymp Trade also specializes in options trading. Users can trade Fixed Time Trades (FTT) and other options contracts, allowing them to profit from predicting the direction of price movements within a specified timeframe.

In conclusion, Olymp Trade offers a diverse range of trading instruments and markets, catering to the needs and preferences of various traders. This variety allows users to create well-rounded portfolios, explore different trading strategies, and capitalize on opportunities across multiple markets.

9. Research tools

The platform provides several research tools, such as economic calendars, market news, and technical analysis indicators. These resources can help traders make informed decisions and refine their strategies.

Olymp Trade Broker Research Tools

Olymp Trade provides a suite of research tools designed to help traders make informed decisions and develop effective trading strategies. The following list highlights the research tools available on the Olymp Trade platform:

- Technical Analysis Indicators: The platform offers a wide variety of technical analysis indicators, such as moving averages, Bollinger Bands, RSI, MACD, and more. These indicators assist traders in identifying trends, support and resistance levels, and potential entry and exit points for their trades.

- Charting Tools: Olymp Trade’s advanced charting tools enable users to visualize market data and conduct in-depth analysis. The platform supports multiple chart types, including candlestick, bar, and line charts, as well as customizable timeframes and drawing tools.

- Market News: The platform provides traders with access to the latest financial news and updates, ensuring they stay informed about market events that could potentially impact their trading strategies.

- Economic Calendar: Olymp Trade offers an economic calendar that displays upcoming economic events and indicators, along with their expected impact on the markets. This tool helps traders stay ahead of market-moving events and plan their trades accordingly.

- Trading Signals: The platform provides trading signals based on technical analysis, allowing traders to identify potential trading opportunities and make informed decisions. These signals can serve as a valuable starting point for further research and analysis.

- Market Analytics: Olymp Trade offers market analytics and insights, including expert opinions, forecasts, and trend analysis. These resources can help traders gain a deeper understanding of market dynamics and develop more effective trading strategies.

- Trading Webinars and Tutorials: The platform regularly hosts webinars and publishes educational content to help traders improve their skills and understanding of the markets. These resources cover a wide range of topics, from trading basics to advanced strategies and techniques.

- Trader’s Blog: Olymp Trade’s Trader’s Blog features articles, guides, and market updates, providing traders with valuable insights and information to enhance their trading knowledge and stay informed about current events.

In conclusion, Olymp Trade offers a comprehensive suite of research tools designed to help traders make well-informed decisions and develop effective trading strategies. These resources cater to traders of all experience levels, from beginners looking to learn the basics to experienced traders seeking advanced analysis and insights.

10. Customer support

Olymp Trade’s customer support is available 24/7 via live chat, email, and phone. The support team is known for its prompt response times and helpful assistance, ensuring that traders receive the guidance they need.

Pros and Cons of Olymp Trade Broker Customer Support

Olymp Trade is committed to providing excellent customer support to its clients. This list highlights the pros and cons of Olymp Trade’s customer support, helping you determine if it meets your expectations.

Pros

- 24/7 Support: Olymp Trade offers round-the-clock customer support, ensuring that traders can receive assistance whenever they need it, regardless of their time zone.

- Multiple Communication Channels: The platform provides various contact options, including live chat, email, and phone support. This ensures that traders can choose the most convenient method for their needs and preferences.

- Responsive Live Chat: The live chat feature on Olymp Trade’s website allows traders to receive quick and efficient assistance, often within minutes. This real-time support can be invaluable in resolving urgent issues or answering time-sensitive questions.

- Help Center and FAQ: Olymp Trade’s Help Center and FAQ section provide a wealth of information and answers to common questions, allowing traders to easily find solutions to many issues without needing to contact customer support directly.

- Support in Multiple Languages: Olymp Trade’s customer support team is available in various languages, ensuring that traders from different countries can receive assistance in their native language.

Cons

- Occasional Wait Times: Although Olymp Trade generally provides prompt customer support, users may sometimes experience longer wait times, especially during peak hours or periods of high trading activity.

- Limited Phone Support Availability: Phone support may not be available in all countries or regions, forcing some traders to rely on alternative contact methods, such as live chat or email, which may not be their preferred option.

- Varying Support Quality: While many users report positive experiences with Olymp Trade’s customer support, others have encountered inconsistencies in the quality of assistance provided. This may result in varying levels of satisfaction among traders.

In summary, Olymp Trade offers comprehensive customer support through multiple channels and languages, with a focus on providing timely assistance. However, some users may experience occasional wait times or inconsistencies in support quality, which may impact their overall satisfaction with the platform’s customer service.

11. Education

The broker offers a comprehensive education section, featuring articles, webinars, and video tutorials for traders of all skill levels. These resources cover various topics, from trading basics to advanced strategies, helping users enhance their trading knowledge.

Olymp Trade Broker Educational Materials

Olymp Trade is dedicated to helping traders of all levels develop their skills and knowledge. The platform offers a range of educational materials designed to cater to different learning styles and preferences. The following list highlights the educational resources available on Olymp Trade:

- Trading Webinars: Olymp Trade regularly hosts live webinars covering various trading topics, from basic concepts to advanced strategies. These webinars provide an interactive learning experience and often include Q&A sessions with industry experts.

- Video Tutorials: The platform features an extensive library of video tutorials that cover a wide range of subjects, such as trading strategies, technical analysis, risk management, and more. These videos cater to different experience levels and can be accessed at any time, allowing traders to learn at their own pace.

- Interactive Courses: Olymp Trade offers interactive online courses designed to provide a comprehensive learning experience. These courses cover various aspects of trading and often include quizzes and practical exercises to test traders’ understanding of the material.

- E-books: The platform provides a selection of e-books that cover various trading topics, from the basics of financial markets to advanced trading techniques. These e-books offer in-depth information and can be a valuable resource for traders looking to expand their knowledge.

- Trader’s Blog: Olymp Trade’s Trader’s Blog features articles, guides, and market updates that provide insights and information on a variety of trading topics. This content can help traders stay informed about market events and trends, as well as enhance their trading knowledge.

- Glossary: The platform includes a comprehensive glossary of trading terms, ensuring that traders can quickly familiarize themselves with the language and concepts used in the financial markets.

- Trading Strategies: Olymp Trade offers detailed guides on various trading strategies, helping traders develop their own approaches and techniques. These strategies cover different timeframes, markets, and risk levels, catering to a wide range of trading preferences.

- Trading Psychology: The platform also provides resources on trading psychology, helping traders understand the mental and emotional aspects of trading and develop the necessary mindset for long-term success.

In conclusion, Olymp Trade offers a diverse range of educational materials designed to cater to traders of all experience levels. These resources can help users build a solid foundation of trading knowledge, develop effective strategies, and ultimately improve their overall trading performance.

12. Demo Account

Olymp Trade offers a free demo account with $10,000 in virtual funds, allowing users to familiarize themselves with the platform and practice their trading skills without risking real money.

Olymp Trade Broker Demo Account Review

Olymp Trade’s Demo Account provides an excellent opportunity for traders to explore the platform’s features and practice their trading skills without risking real money. In this review, we will discuss the benefits and limitations of Olymp Trade’s Demo Account, helping you decide if it’s the right choice for you.

Benefits

- Risk-Free Trading Environment: The Demo Account allows users to trade with virtual funds, eliminating the financial risk associated with real trading. This provides a safe environment for beginners to learn the basics and for experienced traders to test new strategies.

- Generous Virtual Balance: Olymp Trade provides a virtual balance of $10,000 for its Demo Account, ensuring that traders have ample funds to practice and experiment with various trading techniques without running out of virtual money quickly.

- Real-Time Market Data: The Demo Account offers real-time market data and accurate pricing, enabling users to experience the same market conditions as in a live trading environment. This helps traders develop a realistic understanding of market dynamics and improve their decision-making skills.

- Full Access to Trading Tools and Features: Users have access to all the trading tools, features, and instruments available on Olymp Trade’s platform while using the Demo Account. This allows traders to familiarize themselves with the platform’s functionality and develop a comprehensive understanding of the available resources.

- No Time Limit: Olymp Trade’s Demo Account does not have an expiration date, enabling traders to practice and refine their skills at their own pace without feeling pressured to transition to a live account.

Limitations

- Limited Emotional Experience: Trading with virtual funds can limit the emotional experience associated with real trading, as traders may not feel the same level of excitement, fear, or anxiety when making decisions. This can result in different decision-making patterns when transitioning to a live account.

- No Real Profit or Loss: Although the Demo Account helps users learn and practice trading, any profits or losses generated are purely virtual and cannot be withdrawn or converted to real money.

- Potential Overconfidence: Success in a Demo Account may not necessarily translate to success in a live trading environment, as traders may become overconfident and underestimate the risks involved in real trading.

In conclusion, Olymp Trade’s Demo Account offers a valuable learning tool for traders of all experience levels, providing a risk-free environment to practice trading skills and explore the platform’s features. However, users should be aware of the limitations associated with virtual trading and ensure that they are mentally prepared for the emotional and financial challenges of live trading.

13. Safety

Olymp Trade is a member of the International Financial Commission, which provides dispute resolution and compensation in case of misconduct. The platform also employs advanced encryption technologies to protect users’ data and funds. However, it’s essential to note that Olymp Trade is not regulated by any major financial regulatory body, which may be a concern for some traders.

14. Affiliate Program

Olymp Trade offers a competitive affiliate program that rewards partners for referring new clients. Affiliates can earn up to 50% of the revenue generated by their referrals, with no limits on the number of clients they can bring in. The program also includes promotional materials, tracking tools, and dedicated support for affiliates.

Olymp Trade Broker Affiliate Program Review

Olymp Trade’s Affiliate Program is designed to provide individuals and businesses with an opportunity to earn commissions by referring new clients to the platform. This review takes a closer look at the key features, benefits, and drawbacks of the Olymp Trade Affiliate Program.

Key Features

- Attractive Commission Structure: Olymp Trade offers a competitive commission structure for its affiliates, with up to 60% of the broker’s revenue share on successful referrals. This attractive rate allows affiliates to maximize their earning potential.

- Lifetime Earnings: Affiliates can earn commissions for the lifetime of their referred clients’ trading activity, providing a continuous revenue stream as long as the clients continue to trade on the platform.

- Two-Tier Referral System: The program features a two-tier referral system, allowing affiliates to earn additional commissions from the referrals made by their sub-affiliates. This structure can help boost overall earnings and create a more extensive network of clients.

- Marketing Tools and Resources: Olymp Trade provides affiliates with a wide range of promotional materials, including banners, landing pages, and tracking tools. These resources are designed to help affiliates effectively promote the platform and attract new clients.

- Regular Payouts: The program offers regular and timely payouts, with a choice of various payment methods to suit affiliates’ preferences. This ensures that affiliates receive their commissions without delays or complications.

- Dedicated Affiliate Manager: Olymp Trade assigns a dedicated affiliate manager to each partner, providing personalized support and guidance to help affiliates optimize their marketing strategies and maximize their earnings.

Drawbacks

- Exclusions for Certain Countries: Olymp Trade’s Affiliate Program may not be available to residents of certain countries or regions, limiting the scope of potential referrals for some affiliates.

- Approval Process: Affiliates need to go through an approval process to join the program, which can be time-consuming and may result in rejection for some applicants.

- Minimum Payout Threshold: The program has a minimum payout threshold, which means that affiliates must reach a certain amount in commissions before they can receive their earnings. This can be challenging for new affiliates or those with limited referral activity.

In conclusion, Olymp Trade’s Affiliate Program offers a competitive commission structure, lifetime earnings, and a wealth of marketing tools and resources to help affiliates succeed. However, potential drawbacks, such as country exclusions and the approval process, may impact the suitability of the program for some affiliates. Overall, the Olymp Trade Affiliate Program can be a lucrative opportunity for those who can effectively promote the platform and attract new clients.

15. Prohibited countries

Olymp Trade does not accept clients from certain countries due to legal and regulatory restrictions. These include the United States, Canada, European Union member states, Japan, Israel, Iran, Syria, North Korea, and Australia. Traders should always verify if their country of residence permits trading with Olymp Trade before opening an account.

16. Conclusion – Pros and cons

Pros:

- User-friendly trading platform suitable for beginners and experienced traders

- Low minimum deposit of $10

- Transparent fee structure with no hidden charges

- 24/7 customer support

- Comprehensive educational resources and a free demo account

- Competitive affiliate program

Cons:

- Limited range of tradable assets compared to other brokers

- No dedicated desktop trading platform

- Not regulated by any major financial regulatory body

- Not available in several countries, including the United States and the European Union

In conclusion, Olymp Trade is a reliable and user-friendly broker that caters to traders of various skill levels. Its low minimum deposit, transparent fee structure, and comprehensive educational resources make it an attractive option for many traders. However, its limited range of tradable assets and lack of regulation by major financial authorities may be a concern for some potential users. Overall, Olymp Trade is a broker worth considering, but traders should carefully assess their needs and preferences before committing.

Olymp Trade FAQ:

- Is Olymp Trade a scam?

No, Olymp Trade is a legitimate online trading platform that is regulated by the International Financial Commission (IFC). The IFC is an independent regulatory body that ensures the platform operates in compliance with international financial standards.

- What are the minimum deposit requirements on Olymp Trade?

The minimum deposit required to start trading on Olymp Trade is $10, which is significantly lower than other trading platforms in the market. This makes it easier for new traders to start trading with a small capital.

- How do I withdraw money from Olymp Trade?

Withdrawals on Olymp Trade can be made using the same method used for deposits. This includes Visa, Mastercard, Skrill, Neteller, and other electronic payment systems. The withdrawal process is usually completed within 24 hours.

- What trading instruments are available on Olymp Trade?

Olymp Trade offers a wide range of trading instruments, including currency pairs, commodities, stocks, and cryptocurrencies. The platform also offers a variety of trading tools, such as indicators and technical analysis tools, to help traders make informed trading decisions.

- Does Olymp Trade offer demo accounts?

Yes, Olymp Trade offers a free demo account for traders to practice trading without risking real money. The demo account comes with virtual funds, and traders can use it to test their trading strategies and learn how to use the platform.

- What is the customer support like on Olymp Trade?

Olymp Trade has a dedicated customer support team that is available 24/7 to assist traders with any queries or issues they may have. The support team can be reached via email, live chat, or phone.

- What are the education and training resources available on Olymp Trade?

Olymp Trade provides a variety of educational resources to help traders improve their trading skills. These resources include video tutorials, webinars, articles, and eBooks. The platform also has a knowledge base where traders can find answers to frequently asked questions.

What are the opinions about Olymp Trade broker on the internet?

The opinions about Olymp Trade broker on the internet are mixed, with both positive and negative reviews from traders. Some traders praise the platform for its user-friendly interface, educational resources, and responsive customer support. They appreciate the low minimum deposit and trade sizes, as well as the availability of a demo account for practicing trading strategies. Additionally, some traders have reported successful trading experiences on the platform.

However, other traders have criticized Olymp Trade for its lack of transparency and high-risk practices, such as offering high leverage ratios and promoting unrealistic profit expectations. Some traders have reported difficulties with deposit and withdrawal processes, as well as occasional technical glitches on the platform. Moreover, there have been reports of fraudulent activity associated with the broker, although these have not been substantiated.

Overall, it is important for traders to carefully evaluate their options and conduct thorough research before choosing a broker. While Olymp Trade may be a suitable choice for some traders, it may not be the best fit for everyone. It is crucial to consider factors such as regulation, fees, trading instruments, and customer support when selecting a broker to ensure a safe and successful trading experience.

Some populer Olymp Trade alternatives:

- eToro: eToro is a social trading platform that allows users to follow and copy the trades of experienced traders. The platform offers a wide range of trading instruments, including stocks, cryptocurrencies, and commodities. eToro is regulated by multiple financial authorities, and its user-friendly interface makes it an ideal choice for beginners.

- IQ Option: IQ Option is a popular online trading platform that offers a wide range of trading instruments, including forex, stocks, and cryptocurrencies. The platform is known for its user-friendly interface, low minimum deposit, and high payouts. IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC).

- Plus500: Plus500 is a popular online trading platform that offers a range of trading instruments, including forex, cryptocurrencies, and commodities. The platform is known for its low spreads and competitive fees. Plus500 is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK.

- XM: XM is a forex and CFD broker that offers a wide range of trading instruments, including stocks, commodities, and cryptocurrencies. The broker is known for its low spreads, fast execution speeds, and excellent customer support. XM is regulated by multiple financial authorities, including CySEC and the FCA.

- Pepperstone: Pepperstone is a forex and CFD broker that offers a range of trading instruments, including forex, commodities, and cryptocurrencies. The broker is known for its competitive spreads, fast execution speeds, and excellent customer support. Pepperstone is regulated by multiple financial authorities, including ASIC in Australia and the FCA in the UK.

- AvaTrade: AvaTrade is a forex and CFD broker that offers a range of trading instruments, including forex, stocks, and commodities. The broker is known for its low spreads, user-friendly platform, and excellent customer support. AvaTrade is regulated by multiple financial authorities, including the Central Bank of Ireland and the FCA.

- FXTM: FXTM is a forex and CFD broker that offers a wide range of trading instruments, including forex, stocks, and commodities. The broker is known for its low spreads, fast execution speeds, and excellent customer support. FXTM is regulated by multiple financial authorities, including CySEC and the FCA.

- IG: IG is a forex and CFD broker that offers a wide range of trading instruments, including forex, stocks, and commodities. The broker is known for its low spreads, user-friendly platform, and excellent customer support. IG is regulated by multiple financial authorities, including the FCA and ASIC.

- Saxo Bank: Saxo Bank is a Danish investment bank that offers a range of trading instruments, including forex, stocks, and commodities. The broker is known for its low fees, advanced trading platform, and excellent research tools. Saxo Bank is regulated by multiple financial authorities, including the FCA and the Danish Financial Supervisory Authority.

- Interactive Brokers: Interactive Brokers is a US-based online broker that offers a range of trading instruments, including forex, stocks, and options. The broker is known for its low fees, advanced trading platform, and excellent research tools. Interactive Brokers is regulated by multiple financial authorities, including the SEC and the FCA.