Online trading has gained popularity over the years, with many people looking for a reliable broker to work with. Rakuten Securities is one such broker, offering a user-friendly platform, competitive fees, and access to advanced trading tools. In this blog post, we will explore the pros and cons of using Rakuten Securities as a broker and provide tips for maximizing your investment potential.

Overview of Rakuten Securities

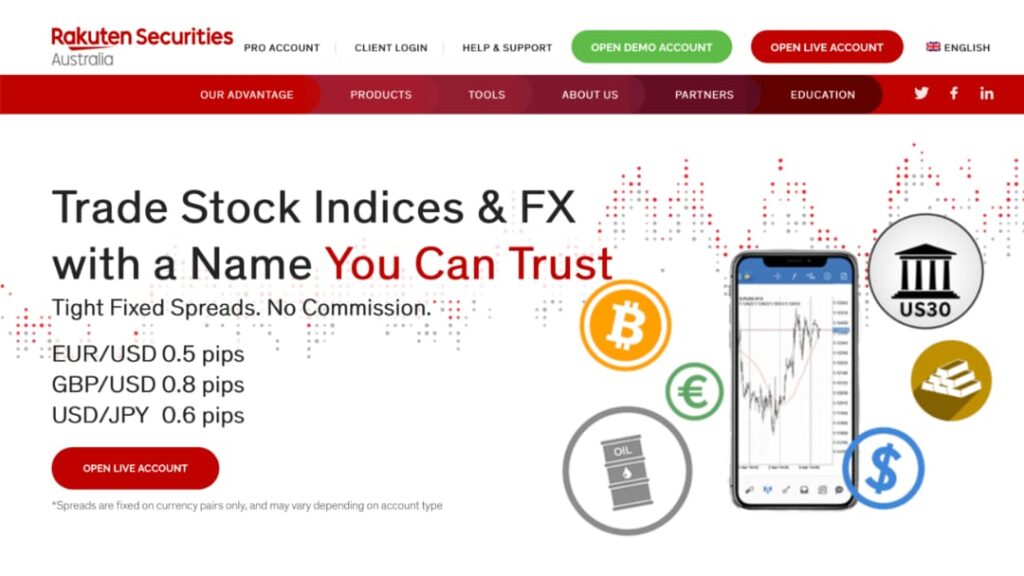

Rakuten Securities specializes in online trading services, offering a range of financial instruments across several markets such as forex, metals, and indices. The company is one of the largest online brokers globally and offers a very competitive trading environment through the powerful MetaTrader platform, a variety of online products, no commission as well as fixed, tight spreads. The company is a dedicated broker that operates with high ethical standards, transparency, safe practices, and excellent support for traders. Rakuten Securities is headquartered in Sydney, New South Wales, Australia.

Rakuten Securities offers a secure trading environment, regulated by reputable financial authorities. Rakuten Securities is regulated by the Australian Securities and Investments Commission (ASIC) and holds an Australia Financial Services Licence (AFSL) No. 418036. This ensures that client funds are protected and subject brokers to regular audits for guaranteed transparency.

Benefits of Using Rakuten Securities as a Broker

Before we dive into the pros and cons of using Rakuten Securities as a broker, let’s first take a look at some of the benefits of choosing this online broker.

Beginner-Friendly Commission

Rakuten Securities has a beginner-friendly commission structure, making it an excellent choice for new investors with small capital looking to get started in the Malaysia and US stock markets. The broker has no minimum account balance requirements, making it easy for beginners to start trading without any major financial commitment.

Access to Malaysia and US Stock Markets

Rakuten Securities provides access to the Malaysia and US stock markets, allowing traders to invest in some of the largest companies in the world. This opens up a world of opportunities for traders looking to diversify their portfolio and take advantage of market trends.

Restricted Capital Markets Services Licence

Rakuten Securities holds a Restricted Capital Markets Services Licence, which means that the broker is authorized to provide financial services to clients within Australia only. While this may be seen as a disadvantage by some traders, it also ensures that Rakuten Securities is fully compliant with local regulations, providing peace of mind to traders.

Pros of Rakuten Securities as a Broker

Now that we’ve covered the benefits of using Rakuten Securities as a broker, let’s take a closer look at some of the pros of working with this online broker.

User-Friendly Platform

Rakuten Securities offers a user-friendly platform that is easy to navigate, making it an excellent choice for beginner traders. The platform is customizable, allowing traders to set up their workspace according to their preferences. Additionally, the platform is available on desktop and mobile devices, ensuring that traders can access their accounts on the go. Enhance your trading abilities with user-friendly MT4 platform.

Competitive Fees and Commissions

Rakuten Securities offers competitive fees and commissions compared to other online brokers. The broker charges no commission and offers fixed, tight spreads, making it an excellent choice for traders looking to trade frequently without incurring high fees.

Access to Advanced Trading Tools

Rakuten Securities provides access to advanced trading tools, including technical analysis tools, economic calendars, and trading signals. These tools can help traders make informed decisions by providing real-time market data and insights.

Responsive Customer Service

Rakuten Securities offers 24/7 customer support through various channels, including email, phone, and live chat. The broker’s support team is knowledgeable and responsive, ensuring that traders can get the help they need quickly.

Cons of Rakuten Securities as a Broker

While Rakuten Securities has several advantages as an online broker, there are also some disadvantages that traders should be aware of before opening an account.

Limited Investment Options

Rakuten Securities offers limited investment options when compared to other brokers. While the broker provides access to major forex pairs, stock index CFDs, as well as commodity CFDs, it may not be the best option for traders looking to invest in other markets or assets.

Minimum Deposit Requirement

Rakuten Securities requires a minimum deposit of $50 USD to open an account. While this is relatively low compared to other brokers, it may still be a barrier for some traders, especially those who are just starting out.

EDUCATION and DEMO ACCOUNT

Education:

Rakuten Securities offers a range of educational resources to help traders enhance their skills and knowledge in trading. These resources include:

- Educational Articles: Rakuten Securities provides a variety of articles covering topics such as market analysis, trading strategies, and risk management. These articles are designed to help traders gain a deeper understanding of the financial markets and improve their trading skills.

- Webinars: Rakuten Securities periodically hosts webinars led by industry experts, who share their insights on market trends, trading techniques, and other relevant topics. These webinars allow traders to learn from experienced professionals and ask questions in real-time.

- Video Tutorials: Rakuten Securities offers video tutorials that cover various aspects of trading, including how to use their MT4 platform, technical analysis, and fundamental analysis. These videos are designed to help traders become more proficient in using the platform and making informed trading decisions.

- Market News and Analysis: Rakuten Securities provides regular market news and analysis to keep traders informed about the latest market developments, economic events, and trends. This information can be valuable for traders when formulating their trading strategies.

- Glossary: Rakuten Securities features a comprehensive glossary that helps traders familiarize themselves with the common terms and concepts used in the trading industry.

- Frequently Asked Questions (FAQs): Rakuten Securities maintains an FAQ section on their website, where traders can find answers to commonly asked questions about the platform, account types, and trading conditions.

Develop Your Expertise in a Safe Setting in DEMO ACCOUNT

Trade using over 50 instruments, including Forex, Metals, and Indices Experience real-time spreads, quick execution, and leverage up to 30:1 for Retail and 400:1 for Pro Our demo accounts utilize the same price feed as our live MT4 platform Practice trading on both your Smartphone and PC.

Forex trading demands skill, enthusiasm, and a thorough understanding of the financial markets. It requires in-depth economic analysis, the ability to identify and seize opportunities, and maintaining control over your emotions. Forex trading also involves significant risk; that’s why beginners in the forex market should always start slow. To assist newcomers in gaining experience before taking bigger risks, Rakuten Securities Australia offers the option of opening a practice account. Demo accounts boast several benefits that help traders ease into the markets.

Evaluate Your EA Strategies in Our Demo Environment

One of the major advantages of MT4 is its seamless integration with EA’s (Expert Advisors), also known as algorithms. With a practice account, you can assess your EA strategy before implementing it in the live market. Even if you’re not proficient in coding, you can still purchase EA’s online through the MT4 marketplace or various other websites.

By offering these educational resources, Rakuten Securities aims to equip traders with the knowledge and skills required to succeed in the financial markets.

Comparison with Other Brokers

It’s always a good idea to compare online brokers before making a decision. Let’s take a look at how Rakuten Securities stacks up against other beginner-friendly and full-service brokers.

Comparison with Other Beginner-Friendly Brokers

When compared to other beginner-friendly brokers, Rakuten Securities offers competitive fees and commissions, a user-friendly platform, and access to advanced trading tools. However, the broker may fall short when it comes to investment options and minimum deposit requirements.

Comparison with Other Full-Service Brokers

When compared to other full-service brokers, Rakuten Securities may not offer as many investment options. However, the broker provides a competitive trading environment, a user-friendly platform, and access to advanced trading tools, making it an excellent choice for traders looking for a reliable online broker.

Tips for Using Rakuten Securities as a Broker

If you decide to use Rakuten Securities as your online broker, here are some tips for maximizing your investment potential:

Maximizing Your Investment Potential

To maximize your investment potential, it’s essential to have a solid trading strategy in place. This means setting clear goals, managing your risk, and diversifying your portfolio. Additionally, it’s essential to stay up-to-date with market trends and news that could impact your investments.

Avoiding Common Mistakes

To avoid common trading mistakes, it’s essential to keep emotions in check and stick to your trading plan. Additionally, it’s essential to avoid chasing trends or getting caught up in hype surrounding certain stocks or markets.

Utilizing Advanced Trading Tools

To make informed trading decisions, it’s essential to utilize advanced trading tools provided by Rakuten Securities. These tools can provide valuable insights into market trends and help you make more informed decisions.

Conclusion

Final Thoughts on Rakuten Securities as a Broker

Overall, Rakuten Securities is a reliable online broker that offers a competitive trading environment, user-friendly platform, and access to advanced trading tools. While the broker may fall short when it comes to investment options and minimum deposit requirements, it’s still an excellent choice for traders looking to invest in the Malaysia and US stock markets. By following the tips outlined in this blog post, you can maximize your investment potential and achieve your trading goals with Rakuten Securities.

Rakuten Securities FAQ

- Q: What is Rakuten Securities?

A: Rakuten Securities is a leading online brokerage firm based in Japan, offering trading services in various financial instruments such as forex, stocks, indices, and commodities. It is a subsidiary of Rakuten Inc., a global internet services company. - Q: How do I open an account with Rakuten Securities?

A: To open an account with Rakuten Securities, visit their official website and follow the account registration process. You’ll be required to provide personal information, verify your identity, and complete a suitability assessment to ensure you understand the risks involved in trading. - Q: What trading platforms does Rakuten Securities offer?

A: Rakuten Securities offers its proprietary Rakuten FX trading platform, as well as the popular MetaTrader 4 platform. Both platforms are available for desktop and mobile devices, providing a seamless trading experience. - Q: Are there any fees associated with Rakuten Securities?

A: Rakuten Securities offers competitive spreads and low fees for its trading services. While specific fees may vary depending on the financial instrument, account type, and trading volume, the broker is transparent about its fee structure on their website. - Q: Is Rakuten Securities regulated?

A: Yes, Rakuten Securities is regulated by multiple regulatory bodies, including the Financial Services Agency (FSA) in Japan, the Australian Securities and Investments Commission (ASIC), and the Securities and Futures Commission (SFC) in Hong Kong. This ensures a secure trading environment and adherence to industry standards. - Q: What type of customer support does Rakuten Securities offer?

A: Rakuten Securities provides multilingual customer support through various channels, such as email, phone, and live chat. The broker’s support team is available to address any questions or concerns you may have about your account or trading experience. - Q: Does Rakuten Securities offer educational resources?

A: Rakuten Securities offers a range of educational resources for traders, including webinars, video tutorials, market analysis, and an extensive FAQ section on their website. These resources cater to both beginner and experienced traders looking to improve their knowledge and skills. - Q: Can I trade cryptocurrencies with Rakuten Securities?

A: Rakuten Securities does not currently offer direct cryptocurrency trading. However, they do provide trading opportunities in cryptocurrency-related CFDs, allowing you to speculate on price movements without owning the underlying asset. - Q: What are the minimum deposit requirements for Rakuten Securities?

A: The minimum deposit requirements at Rakuten Securities vary depending on the account type and jurisdiction. It’s essential to check their website or consult with their customer support for specific information about your region. - Q: Can I use leverage while trading with Rakuten Securities?

A: Yes, Rakuten Securities offers leverage for various trading instruments, allowing traders to control larger positions with a smaller amount of capital. Leverage levels depend on the financial instrument and regulatory jurisdiction. Keep in mind that using leverage carries a higher risk and may not be suitable for all traders. - Q: Does Rakuten Securities offer a demo account?

A: Rakuten Securities provides a free demo account for traders who wish to familiarize themselves with the trading platform and practice their trading strategies without risking real money. The demo account comes with virtual funds and replicates the live trading environment. - Q: Are there any promotions or bonuses available with Rakuten Securities?

A: Rakuten Securities occasionally offers promotions and bonuses to new and existing clients. These offers may include deposit bonuses, cashback promotions, and more. It’s essential to keep an eye on their website or contact their customer support for the latest promotional offers.

Remember to conduct thorough research and compare Rakuten Securities with other brokers to find the best fit for your trading needs and objectives.

Here is the list of Rakuten Securities Broker alternatives:

- Interactive Brokers: A popular choice for experienced traders, Interactive Brokers offers a wide range of instruments, competitive commissions, and advanced trading tools.

- XM Group: Known for its user-friendly trading platforms and comprehensive educational resources, XM Group is a great option for traders at all experience levels.

- Pepperstone: Offering competitive spreads and fees, Pepperstone has a solid reputation among forex traders and provides access to numerous global markets.

- IG Markets: As one of the world’s largest online trading platforms, IG Markets offers a vast range of instruments, advanced charting tools, and an extensive range of educational resources.

- Forex.com: With its focus on forex trading, Forex.com provides a competitive and easy-to-use platform for traders looking to dive into the currency markets.

- Admiral Markets: A multi-asset broker with a strong reputation, Admiral Markets provides clients with access to a range of instruments, multiple trading platforms, and valuable educational resources.

- OANDA: Known for its transparent pricing, OANDA is a reliable choice for traders who prioritize fair fees and a wide range of forex pairs.

- FXTM: Offering tight spreads and fast execution, FXTM is a suitable choice for both beginner and advanced traders interested in forex and CFD trading.

Always make sure to research and compare different brokers before making a decision. Consider factors such as fees, trading platforms, customer support, and available instruments to find the broker that best suits your trading needs and preferences.

Useful links:

- https://www.crunchbase.com/organization/rakuten-securities

- https://www.daytrading.com/rakuten-securities

- https://forexsuggest.com/rakuten-securities-review/

- https://tradingbrokers.com/reviews/rakuten-securities-review/

Rekuten Securities Official Website, Support and Social Media:

- Official Website: https://global.rakuten.com/corp/

- Support: https://sec.rakuten.com.au/contact/ email: support@sec.rakuten.com.au

- Twitter: https://twitter.com/RakutenSecAU

- Facebook: https://www.facebook.com/RakutenSecAU/

- LinkedIn: https://au.linkedin.com/company/rakuten-securities-australia

Other articles about Rakuten Securities broker:

- “Exploring Rakuten Securities’ Unique Features: A Comprehensive Guide for New and Experienced Traders”

- “Rakuten Securities’ MT4 Platform: A Step-by-Step Guide for Effective Trading”

- “Understanding Leverage and Margin Requirements at Rakuten Securities”

- “Rakuten Securities Mobile Trading: Tips for Trading on the Go”

- “How to Use Technical and Fundamental Analysis in Your Rakuten Securities Trading Strategy”

- “Rakuten Securities’ Account Types: Which One is Right for You?”

- “Risk Management Techniques for Successful Trading with Rakuten Securities”

- “Navigating the World of Forex: A Beginner’s Guide to Trading with Rakuten Securities”

- “Transitioning from a Demo Account to Live Trading with Rakuten Securities”

- “A Deep Dive into Rakuten Securities’ Educational Resources: Learning from the Experts”

- “The Impact of Economic Events on Forex Trading: How Rakuten Securities Keeps You Informed”

- “Rakuten Securities and Social Trading: Exploring the Benefits of Community Interaction”

- “Mastering the Art of Scalping and Day Trading at Rakuten Securities”

- “Long-term Trading Strategies for Success with Rakuten Securities”

- “Expert Advisor (EA) Trading: How to Implement Automated Strategies at Rakuten Securities”

These article ideas will provide your readers with a well-rounded understanding of Rakuten Securities as a broker and offer helpful insights into various aspects of trading.