This educational material is courtesy of IQoption broker. Find out more here.

General Risk Warning: The financial services provided by this website carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose

Japanese candlesticks are the most often used chart type.

Japanese candlesticks first used by Japanese rice traders over 200 years before the first charts appeared in America.

Video – Japanese Candlesticks

Why do we need them?

- Help to analyze the price movements.

- Define the entry points.

The Japanese candlesticks are very helpful in defining the chart patterns. These patterns can indicate a reversal or the trend continuation. Reversal or continuation of a trend enables the trader to make profit.

How to turn on the candles

1. Switch your chart into Japanese candles (10 seconds for Turbo options, 30 seconds for binary options)

2. The chart will be displayed on your platform, so you can start the analysis.

How does it work?

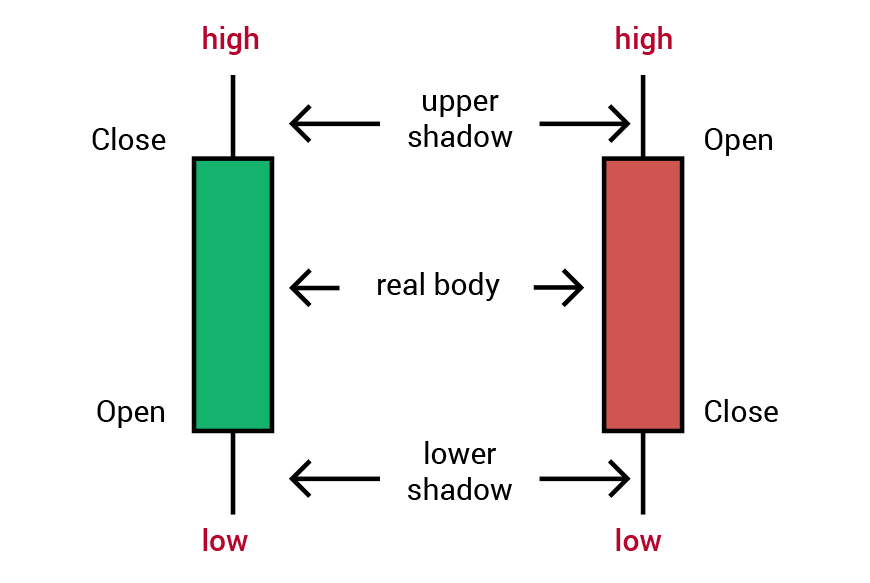

The Japanese candles consist of upper and lower shadows on the ends of the candlestick body. The candle represents an interval between the opening and closing prices. If the market moved up, the candle body is green; if the marked moved down, the candle body is red.

In the candlestick analysis, the trader’s main task is to identify the chart patterns. These patterns can predict reversal or continuation of a trend. If the trader notices that the market situation is changing, he will be able to quickly react and get more profit than those who see the trend in full swing.

There are a few simple strategies based on the candlestick analysis.

By using these strategies, you will be able to predict the trend reversal.

1. Piercing Line Candlestick Pattern (Uptrend)

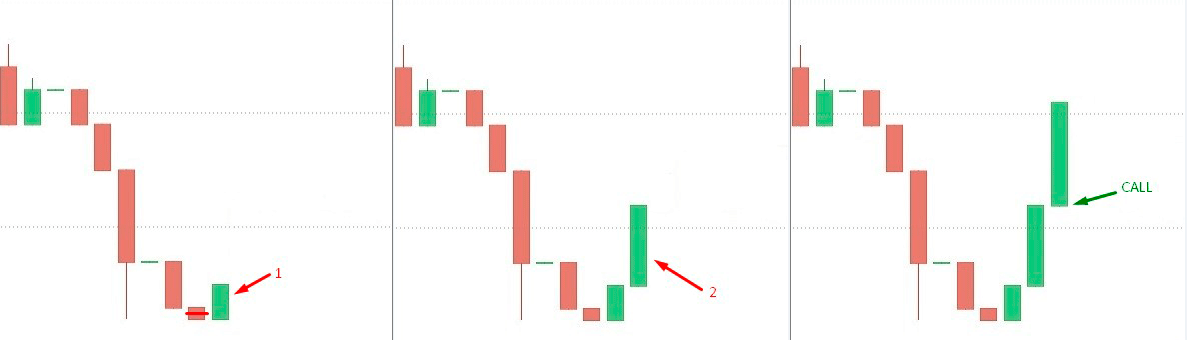

“The Piercing Line pattern” – trading strategy that helps to determine the upward reversal on the downtrend (consisting of two candles).

Simple layout:

- Find two candles on the chart, one of which closes above the middle of the body of the previous descending candle.

- Wait for the second ascending candle.

- When the third ascending candle appears, buy call option.

2. Three Black Crows Strategy (Downtrend)

“Three black crows “ – trading strategy aimed at defining the downward reversal on the uptrend (consisting of long descending candles).

Simple layout:

- Find a strong uptrend consisting of several ascending (green) candles in a row;

- Wait for a reversal – three descending (red) candles in a row

- After closing the third candle, buy put option.

Advanced usage

The candlestick patterns are traditionally referred to as “reversal patterns” or “kicker patterns” as they warn about changing trends (not necessarily a reversal), when the trend graduates into a flat or the current movement slows down within one trend. For this reason, when using the candlestick patterns, we should also take into account other indicators like support and resistance levels, resistance, the Moving Averages, etc.

This educational material is courtesy of IQoption. Find out more here.

General Risk Warning: The financial services provided by this website carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose