Heiken Ashi is a better way to read a candlestick chart. You can more accurately predict patterns and price movements. It’s now on IQOption.

Heikin-Ashi technique

For the first time, Japanese investment techniques were used in the American and European markets in the early 1990s. The basic Japanese techniques include Japanese candles, Renko, Kagi, breaking three lines and Ichimoku1. The use of these techniques has led to a completely new perception of the forces of supply and demand governing prices on the American and European exchanges. The most popular among many Japanese techniques are Japanese candles. The Heikin-Ashi2 technique is a kind of modification of this method, the main task of which is to eliminate noise from the classic Japanese candle technique. Undeniably, as a result of simple coincidences, a much better picture of trends and areas of consolidation (bases) is obtained.

Heiken Ashi on IQ Option

IQ Option, in its effort to end up being the very best platform for trading CFD, forex and cryptocurrency, has actually exposed that it has actually introduced the Heiken Ashi charts. For those of you who have actually not yet become aware of the Heik Ashi, I will now describe this candlestick chart much better. The Heiken Ashi is a sophisticated type of candlestick chart that permits traders to recognize patterns and forecast future price movements.

Heiken Ashi in practice – how to read the price movement candlestick

Certainly, the fundamental candlesticks are the same, however, the estimation on which they are based is extremely various. While a conventional candlestick is based upon the very same opening-maximum-minimum-close worths of a bar chart, the Heiken Ashi utilizes the mean values and the centre point of the previous candlestick for setting the criteria. Here is what the formula appears like:

- closing = (opening + maximum + minimum + closing) / 4, equal to the average price for the current bar or candle.

- Opening = (opening of the previous candle + closing of the previous candle) / 2, equal to the central point of the previous candle.

- Maximum = opening, closing or maximum of the current spark plug, any of these values is the highest.

- Minimum = opening, closing or minimum of the current spark plug, any of these values is lower.

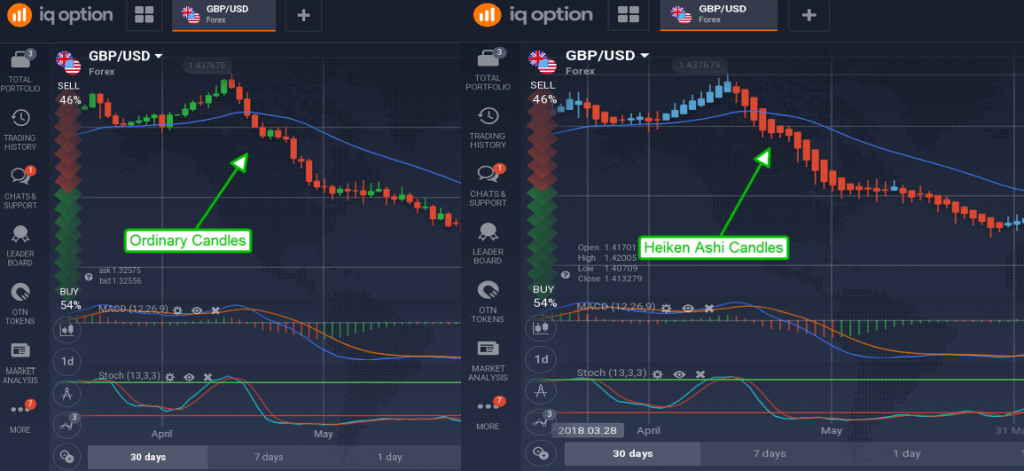

For example here is an example of what Heiken Ashi looks like compared to the same chart that uses traditional candles. On the Heiken Ashi chart, the rising days are shown in blue and those in decline in red.

Advantages of the Ashi Asik

There are some advantages of the Heiken Ashi that are immediately visible.

The first is fluidity, the Heiken Ashi chart creates an extremely fluid flow of price movement, without the sharp falls and the typical leaps created by the price movement.

The second is the colour. And while a candlestick chart can produce a red or green candle on any day, the Ashi Hebe candles tend to be red during the downtrend and blue during the upward trend.

The third is the price scale, as the Heiken Ashi uses an average price for the closing of the candles (traditional candles use the current price as a closing), there may be a discrepancy between the “current” price of the asset and the price indicated as closing the candle.

There are 5 main indications that Heiken Ashi produces and which traders can exploit.

- The first is the blue candles without the lower shadow. They indicate a strong trend; Traders should open new trades or leave those in progress open for maximum profit.

- The second is a series of blue candles. They indicate an upward trend; traders should raise on long positions and close short ones.

- The third is the small red or blue candles with visible upper or lower shadows. They indicate an imminent change in direction of the trend; traders should lock profits on open positions and reverse the approach to new positions.

- The fourth is a series of red candles. They indicate a downward trend; traders should raise on short positions and close long ones.

- The fifth is a candle without a higher shadow. It indicates a strong downward trend in which traders should open new short positions or re-launch existing ones.

Video explanation for beginners – Heiken Ashi strategies

Source:

IQOption blog

https://www.investopedia.com/trading/heikin-ashi-better-candlestick/

How to trade CFD? (00:49)

How to trade CFD? (00:49) How to trade binary options*? (01:22)

How to trade binary options*? (01:22) Forex. How to start? (01:01)

Forex. How to start? (01:01)